ict fibonacci settings

Fibonacci refers to the Fibonacci sequence, which is a series of numbers named after the Italian mathematician Leonardo of Pisa, also known as Fibonacci. He introduced this sequence to the Western world through his book “Liber Abaci” (1202), in which he used the sequence to describe the breeding of rabbits.

The Fibonacci sequence starts with two numbers, 0 and 1, and each subsequent number in the sequence is the sum of the two preceding ones. Therefore, the sequence begins like this:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, …

To generate the sequence, you add the last two numbers to obtain the next number. For example, 1 + 1 = 2, 1 + 2 = 3, 2 + 3 = 5, and so on.

It also has important applications in mathematics, computer science, trading, crypto, and other financial markets.

How To Set ICT Fibonacci Levels

ICT Fib levels are those levels where we can find optimal trade entry(OTE). These level and their descriptions are given below.

| 0 | First Profit Scaling |

| 0.505 | Equilibrium (50% level) |

| 0.618 | 62% Retracement |

| 1.0 | 100% (original position) |

| 0.705 | Optimal Trade Entry (OTE) |

| 0.79 | 79% Retracement |

| -0.62 | Target 2 |

| -0.27 | Target 1 |

| -1 | Symmetrical Price |

ICT Fibonacci Levels

ICT Fib Settings Tradingview

To set the ict Fibonacci level on Trading View, do the following

To use Fibonacci retracements for trade entries and take profit zones, follow these steps:

- Set up Fibonacci Settings:

- Click on the Fibonacci retracement tool in your trading platform.

- Place it on the chart by clicking and dragging from the swing high to the swing low (or vice versa) that you want to use as reference points.

Adjust Fibonacci Levels

- Adjust Fibonacci Levels:

- Double-click the Fibonacci retracement tool on the chart.

- Right-click on the tool to access the settings.

- Go to “Fib levels” and modify the levels as follows:

- After setting the levels, click “Save” to apply the changes.

How to Apply ICT Fib Settings on the Chart

How to Apply ICT Fib Settings on Chart

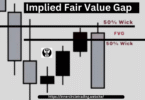

In the ICT trading strategy, when using Fibonacci retracement levels, we place the tool from the lowest point to the highest point of the candle’s body if the market is going up (bullish momentum) and from the highest to the lowest point in bearish momentum.

We do this because the highs and lows of candles can differ between brokers, making them less reliable. By focusing on the bodies of the candles, we can find the best spot to enter a trade with good profit potential, regardless of the broker we use. This helps us make better trading decisions and increases the chances of successful trades.

ICT Optimal Trade Entry (OTE)

In the ICT trading strategy, Optimal Trade Entry (OTE) levels are points in the market where there is a significant retracement in a particular direction. Traders look for specific entry setups at these levels.

When traders identify an OTE level, they are looking for potential trade opportunities. They seek setups or signals that indicate the market is likely to reverse from the retracement and continue in the direction of the overall trend. By focusing on these OTE levels, traders aim to find favorable entry points that offer a good risk-to-reward ratio for their trades.

You can combine ict premium and discount concepts with these ICT OTE fib levels for additional confluence.

How should I position my stop-loss orders for a trade that anticipates a price rise?

For a trade anticipating a price increase, it’s wise to position stop-loss orders just below the selected Fibonacci levels. This approach helps protect against potential losses if the market moves in the opposite direction. By setting stop-losses beneath these key Fibonacci retracements, traders can manage risk while giving the trade enough room to move in the anticipated upward direction.

What are the ideal Fibonacci (FIB) levels to consider when entering a trade?

The ideal Fibonacci levels for entering a trade are typically in the range of 0.62 to 0.79. These levels are considered strategic points for making trade decisions because they often represent significant support or resistance levels within the market. By aligning trade entries with these Fibonacci retracements, traders aim to enter the market at points where a

What strategies can I use to refine my entry points with Fibonacci levels?

To refine your entry points using Fibonacci levels, focus on the specific retracement levels between 0.62 and 0.79. These levels are particularly useful for identifying potential reversal points in the market and combined with premium and discount array.

By waiting for the price to reach these levels and showing signs of reversal, such as through candlestick patterns or other technical indicators, you can optimize your entry points. This strategy aims to increase the likelihood of entering the trade at a more favourable price, thereby enhancing the profit potential.

What is Optimal Trade Entry (OTE) in the context of trading?

Optimal Trade Entry (OTE) is a concept that emphasizes finding the most advantageous entry point in a trade, balancing the goals of minimizing risk and maximizing reward. This approach is crucial for effective money management and achieving a desirable risk-to-reward ratio.

OTE often involves identifying key market levels, such as specific Fibonacci retracements, and waiting for confirming signals that indicate a high probability of market movement in the desired direction. By carefully selecting entry points, traders aim to improve their trading outcomes, ensuring that they enter the market at moments that offer a higher chance of success.

Leave a Comment