ICT Core Content -02 Notes Crafting Trade Setup and Effective Risk Management

A. Crafting Effective Trade Setups

1) Optimal Time Frame Selection

Choosing the right time frame for your trade setups is crucial. Higher time frames provide a broader market perspective, reducing noise and allowing for more accurate analysis.

2) Institutional Alignment

Aligning your analysis with major institutions, which often operate on daily, weekly, and monthly scales, can significantly impact your trading success. Their actions and analyses carry substantial influence in the market.

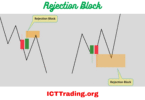

3) Strategic Price Level Identification

Identifying price levels that align with institutional order flow is a strategic move. These levels often attract significant buying or selling interest, making them important considerations for successful trades.

4) Meticulous Planning on Higher Time Frames

Higher time frame setups evolve gradually, offering ample time for thorough trade planning. This ensures well-informed decisions and potentially lowers the overall trade risk.

B. Effective Risk Mitigation Strategies

1) Leveraging Higher Time Frames for Analysis

Emphasizing higher time frames in your analysis helps in identifying significant trends and reduces the impact of short-term price fluctuations, resulting in more consistent and less risky trades.

2) Refining Analysis for Lower Time Frames

Adapting higher time frame conditions to lower time frames allows for a more detailed assessment of potential trade setups. This alignment aids in risk reduction while retaining the overarching trend perspective.

3) Precision with Transposed Key Levels

Transposing critical price levels from higher time frames to lower time frames enhances precision in pinpointing entry and exit points. This contributes to tighter stop-loss placement and ultimately reduces risk.

4) Optimizing Stop Loss Placement

By refining higher time frame levels for lower time frame charts, you can strategically place smaller stop losses, minimizing potential losses and overall trade risk.

C. Managing Fear and Losses

1) Overcoming Fear-Based Decision Making

Fear of losses can lead to irrational decision-making. It’s crucial to trade based on a well-considered strategy rather than being driven by anxiety or fear.

2) Adopting a Professional Mindset

Understanding that losses are a part of trading and considering them as a cost of doing business helps maintain a long-term perspective. This focus on profitable strategies contributes to overall profitability.

3) Balancing Risk and Reward

Structuring trades to achieve potential reward ratios significantly higher than the risk, like a 3:1 ratio or better, lays a solid foundation for profitable trading despite losses.

4) Efficient Trade Setup Definitions

Crafting trade setups with a 5:1 reward-to-risk ratio or greater efficiently covers losses, enhancing overall profitability in trading.

Incorporating these strategies into your trading approach will undoubtedly refine your trading acumen and improve your ability to navigate the dynamic world of financial markets. Stay disciplined, remain adaptive, and let these insights guide you toward success in your trading endeavors.

| ICT Core Content Month 2 Part 1 |

| ICT Core Content Month 2 Part 2 |

| ICT Core Content Month 2 Part 4 |

Leave a Comment