ICT Judas Swing

The term “Judas swing” refers to a false move in the market that tricks traders into believing it will continue in a particular direction and trap them.

Main Characteristics of ICT Judas Swing

The London Judas Swing refers to a false move in the market during the London session that tricks traders into believing the price will continue in a particular direction but then reverses.

Focus on trading and identifying the London Judas Swing between New York midnight to 5 AM (New York Local Time).

Trade London Judas Swing

Bearish Scenario

Bearish Scenario

Mark Highs and Lows of the Asia Session:

- Identify the highest and lowest price levels reached during the Asia session.

Mark New York Midnight Candle Opening:

- Identify the opening price of the candle at New York midnight (NY 00:00).

Check Price Trading Above New York Midnight:

- During the London Kill Zone (typically from the start of the London session until around 5:00 AM NY local time), check if the price is trading above the opening price of the candle in New York midnight.

Check for Liquidity Grab at Asian High:

- If the price is trading above the New York midnight opening during the London Kill Zone, check for a liquidity grab at the Asian session high.

Identify Market Structure Shift:

- Look for signs of a market structure shift, indicating a potential change in the market direction.

Find Favorable Entry (Fvg) Point:

- Based on the market structure shift and liquidity grab, identify a favorable entry point that aligns with the anticipated market direction.

Set Target:

- In an ideal scenario, set the target at the Asian session low or any visible sell-side liquidity, aiming for a profitable trade.

Bullish Scenario

Bullish Scenario

Here’s a step-by-step breakdown for the bullish scenario, focusing on identifying a liquidity grab at the low of the Asian session during the London Kill Zone, finding the Market Structure Shift (MSS), determining a favorable entry point (FVG or IFVG), and setting the target at the Asian session high or buy-side liquidity:

Identify Liquidity Grab at Asian Session Low:

- During the London Kill Zone (between New York midnight to 5 AM NY local time), observe if the price trades above the New York midnight opening and check for a liquidity grab at the Asian session low.

Find Market Structure Shift (MSS):

- Look for a significant change or shift in market structure, such as a clear indication of a potential bullish movement.

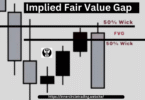

Determine Favorable Entry (FVG or IFVG):

- Based on the observed market structure shift and liquidity grab, identify a favorable entry point (FVG) or an improved favorable entry point (IFVG) that aligns with the anticipated bullish movement.

Set Target:

- In this bullish scenario, set the target at the Asian session high or any visible buy-side liquidity, aiming for a profitable trade.

Trade New York Judas Swing

Trade New York Judas Swing

Bearish Scenario

Time Frame:

- Focus on trading from 7:00 AM to 9:00 AM (New York Kill Zone)

Price Condition:

- Confirm the price is trading above 7:00 AM and the NY Opening.

Buy Side Liquidity Hunt:

- Wait for a move higher to trigger buy orders (liquidity hunt).

Market Structure Shift (MSS):

- Look for a significant shift indicating a potential bearish direction.

Favorable Entry (FVG or IFVG):

- Identify a strategic entry point aligning with the expected bearish movement.

Target:

- Aim for sell-side liquidity or visible sell-side order clusters.

Leave a Comment