ICT Market Maker Model PDF

Key Elements of the ICT Market Maker Buy/Sell Model

Premium and Discount (PD) Array:

PD Array( Premium and Discount): identifies areas on the chart where “smart money” is interested in buying or selling, potentially causing a reversal or significant price movement. The reversal can be short-term or long-term, depending on the timeframe analyzed.

High Probability PD (Premium and Discount) Arrays: These are specific zones within the PD Array where the probability of a reversal is considered particularly high.

- Order Blocks (Breaker + Mitigation): These are areas where the market maker places large orders to manipulate prices and trap retail traders.

- Liquidity (BSL, SSL): These are areas where the market maker accumulates orders to create a “false breakout” or “false breakdown” to trap retail traders and take liquidity. Learn what liquidity is

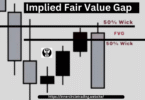

- FVGS (BISI, SIBI): These are specific price levels where the market maker is likely to place large orders to manipulate the price.

What is MMXM?

MMXM

MMXM stands for “Market Maker Sell Model.” It’s a blueprint for predicting how price will behave when transitioning from a bullish PD Array to a bearish PD Array and vice versa. Understanding this model can help make trading decisions with tighter stop-losses and a higher probability of success.

Market Maker Sell Model Steps:

Market Maker Sell Model

- Higher Time Frame (HTF) Market Structure: Confirm that the HTF market structure is bearish. This indicates the overall trend is down.

- PD Array: Identify the next PD Array on the chosen timeframe (usually Daily or 4-hour). This is where “smart money” might be interested in selling and pushing the price lower.

- DOL & Liquidity: Analyze the drawn-on Liquidity (DOL) and Liquidity zones (BSL, SSL) within the PD Array. This helps pinpoint potential entry and exit points for your trades.

- Order Blocks & FVGS: Look for Order Blocks and FVGS levels within the PD Array. These can be used for confirmation of the sell model and for setting stop-loss orders.

Market Maker Buy Model:

The Market Maker Buy Model (MMBM) follows the same principles but in reverse. It’s used to identify potential buying opportunities when the market is transitioning from a bearish PD Array to a bullish PD Array.

Market Maker Buy Model

Key points to remember:

- MMXM is a framework for understanding how “smart money” might influence the market.

- It’s important to use other technical analysis tools in conjunction with MMXM to confirm trade ideas.

- Always practice proper risk management and set stop-loss orders to protect your capital.

Chart Example

The EURUSD chart illustrates a market maker’s buying model. Before making any aggressive moves, smart money typically accumulates its orders, then strategically traps retail traders’ mindsets to drive the market in the desired direction.

Who is called a market maker?

A market maker is an entity, often a large bank, financial institution, or brokerage firm, equipped with substantial capital, committed to the continuous buying and selling of a specific stock at publicly listed prices. These entities, collectively referred to as market makers or smart money, possess the capacity to influence market trends toward their favored direction due to their profound market insights and financial leverage.

How Does Smart Money Influence Price Movements?

Smart money refers to the investments made by people with a deep understanding of the market and its trends. These people might be large institutional investors or very experienced individual traders. Their actions can influence price movements because they invest large amounts of money. When they buy or sell a certain stock or asset, it can lead to significant price changes due to the large volume of the transaction.

How Can Traders Build Confidence in Their Market-Maker Strategies?

Traders can build confidence in their market maker strategies by gaining a deep understanding of the market and the securities they are dealing with. This involves studying market trends, understanding the factors that influence price movements, and practicing with smaller amounts before committing large investments.

Most importantly, they aligned their trade with IPDA data ranges and liquidity.

What is a market maker model?

This model examines the influence of smart money on market dynamics. By analyzing the trading patterns of these major players, retail traders can better align their strategies with the direction favored by market makers.

Leave a Comment