Price action traders are always on the lookout for reliable patterns that signal high-probability trades. One such pattern is the Rally Base Rally (RBR), a bullish continuation setup that helps traders catch strong upward moves after a brief consolidation.

Whether you trade stocks, forex, or cryptocurrencies, the RBR pattern can be a valuable addition to your strategy. In this guide, we’ll break down how to identify, trade, and profit from RBR setups while avoiding common pitfalls.

What is the Rally Base Rally (RBR) Pattern?

Rally Base Rally

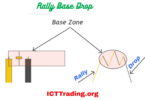

The Rally Base Rally (RBR) pattern is a three-phase bullish continuation formation:

- Rally (First Move Up): A strong upward price movement, often with increasing volume.

- Base (Consolidation/Pullback): A pause or slight retracement where the price stabilizes.

- Rally (Second Move Up): A breakout above the base, continuing the uptrend.

This pattern is similar to a bull flag or cup and handle, but focuses more on the momentum before and after the consolidation.

Why Does RBR Work?

- The first rally shows strong buying interest.

- The base represents a temporary pause before buyers regain control.

- The second rally confirms that the trend is resuming.

How to Identify a Valid RBR Setup

Not every pullback leads to a continuation. Here’s how to spot high-probability RBR trades:

1. First Rally: Strong Momentum

- A clear, impulsive upward move (large bullish candles).

- Ideally, it is accompanied by higher volume (which indicates strong buying pressure).

2. Base: Healthy Consolidation

- The pullback should be shallow (ideally 38.2%–50% Fibonacci retracement).

- Tight price action (small candles, low volatility).

- Volume decreases during the base (shows weakening selling pressure).

3. Second Rally: Confirmation Breakout

- Price breaks above the base with strong momentum.

- Volume increases on the breakout (confirms buyer participation).

Example Chart:

How to Identify a Valid RBR Setup

How to Trade the RBR Pattern

How to Trade the RBR Pattern

Entry Strategies

- Breakout Entry: Enter when the price closes above the base resistance.

- Pullback Entry: Wait for a retest of the breakout level before buying.

Stop Loss Placement

- For breakout entries: Below the lowest point of the base.

- For pullback entries: Below the recent swing low.

Take Profit Targets

- 1:1 Risk-Reward Minimum: Measure the height of the first rally and project it from the breakout point.

- Alternative: Use previous resistance levels or trail stops for extended moves.

Advantages & Limitations of RBR Trading

Pros:

- Works across multiple markets (stocks, forex, crypto).

- Simple to identify with clear rules.

- High reward potential if the trend extends.

Cons:

❌ False breakouts can occur (always wait for confirmation).

❌ Requires patience, not all pullbacks lead to continuations.

Conclusion

The Rally Base Rally (RBR) pattern is a powerful tool for traders who want to capitalize on bullish continuations. By waiting for strong momentum, a healthy base, and a confirmed breakout, you can improve your odds of catching strong trends.

Learn:

Leave a Comment