In the world of Stock and FX market trading, the Three Inside Up candlestick pattern stands as a beacon, signaling a potential shift from bearish to bullish trends.

This intricate pattern is not just a sequence of candlesticks; it’s a narrative of market psychology, a strategy guide, and a tool for optimizing trades. Let’s dive into the details of this compelling pattern.

Understanding the Three Inside Up Pattern

The Psychology Behind the Pattern

At its core, the Three Inside Up pattern is a tale of market transformation. It begins with a bearish candlestick, representing the dominance of sellers and a prevailing downward trend.

However, as the pattern unfolds with two bullish candlesticks, it paints a picture of waning bearish momentum and a growing influence of buyers. The final bullish candlestick, surpassing previous highs, is the climax, signifying a power shift from sellers to buyers and hinting at a rising market confidence.

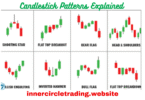

The Anatomy of the 3 Inside UpPattern

- The Opening Act: A bearish candlestick with a long body, signaling the ongoing strength of the downtrend.

- The Plot Twist: A smaller bullish candlestick, suggesting a brewing change in market sentiment.

- The Finale: A bullish candlestick, opening at or above the close of the second and closing above the high of the first, confirming the trend’s reversal.

Crafting a Strategy Around the Pattern

Entry and Exit Points

- Entering the Stage: The pattern’s completion marks the cue for entering trades, as it signals the start of an uptrend.

- Taking a Bow: Exiting at new highs or when other market indicators hint at the end of the bullish phase.

The Role of Color in the Pattern

Colors are not just visual aids but narrators of market strength and direction. The initial red candlestick tells a story of a robust downtrend, while the green candles weave a tale of an emerging bullish trend.

The Pattern in the Wild

While common in stock markets, its frequent sightings can be deceptive. Not every Three Inside Up pattern foretells a strong reversal, making it crucial to discern the true signals from the false alarms.

Technical Analysis: Reading Between the Lines

This pattern is a compass in technical analysis, pointing to the magnitude of a reversal and informing entry and exit strategies.

Factors Influencing Accuracy

The reliability of this pattern is shaped by the duration of the trend, the time frames of the candlesticks, and the overall market context.

Timing is Everything

- For Buyers: The moment following the formation of the third bullish candlestick is optimal for buying.

- For Sellers: As the bearish trend begins to fade, it’s time to consider selling.

Trading Strategy

- Spotting the Pattern: Use visual cues and contextual understanding to identify the formation.

- Seeking Confirmation: Language patterns can help affirm that market conditions align with the candlestick pattern.

- Managing Risks: Employ stop-loss orders and positive affirmations to maintain clarity in decision-making.

- Booking Profits: Clear communication is key in setting profit targets and planning exit strategies.

- Staying Vigilant: Continuously assess the market, using language as a tool for reassessment and adaptation.

Pros and Cons:

- Advantages: Offers regular opportunities due to its frequent occurrence and indicates the strength of trend reversals.

- Disadvantages: Risks include false signals due to incomplete formations and challenges in real-time identification.

Beyond the Three Inside Up

- Contrast with Three Inside Down: This inverse pattern signals a shift from bullish to bearish trends.

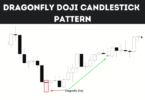

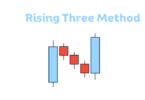

- Related Patterns: The Morning Star, a similar bullish reversal indicator, and various Doji patterns, which indicate market uncertainty and potential reversals.

In conclusion, the Three Inside Up candlestick pattern is more than just a technical indicator; it’s a window into market psychology and a guide for strategic trading. By understanding its nuances, traders can harness its power to anticipate and capitalize on trend reversals, making informed decisions that can lead to successful trades.

Leave a Comment