What Is SIBI and BISI in ICT

Understanding the Inner Circle Trader (ICT) concepts of bullish and bearish Fair Value Gaps (FVGs) is crucial for implementing this particular trading strategy effectively. Let’s break down these concepts from the ICT perspective and how they apply to trading decisions.

Bullish Fair Value Gap (FVG) – BISI

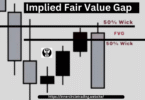

The Bullish FVG, as defined by ICT, is termed as a Buy Side Imbalance Sell Side Inefficiency (BISI). This scenario occurs in the market when there’s a strong upward price movement primarily driven by buyers, with little to no counteracting selling pressure. This creates what’s known as a ‘gap’ — an area where the price moved up rapidly without much trading occurring in that range.

How I Apply This Concept:

- Identifying the Gap: I look for areas on the chart where a rapid upward movement has left a gap, indicating a BISI.

- Entering Trades: My strategy involves waiting for the price to retrace back into this gap. The rationale is that the market often moves to fill these imbalances, creating an opportunity for a long (buy) position.

- Setting Stop Loss: In terms of risk management, I typically place my stop loss below the body of the second candle or the body of the first candle in the bullish FVG formation. This helps protect my trade from unexpected downturns.

Bearish Fair Value Gap (FVG) – SIBI

Conversely, the Bearish FVG, or Sell Side Imbalance Buy Side Inefficiency (SIBI), is characterized by a strong downward price movement driven predominantly by sellers, with minimal buying pressure to counteract it. Similar to the bullish FVG, this creates a gap indicating an SIBI.

How I Apply This Concept:

- Spotting the Gap: I look for rapid downward movements on the chart that have left behind a noticeable gap.

- Executing Trades: My approach here is to wait for the price to revisit this gap. The expectation is that the market will attempt to ‘fill’ this gap, offering an opportunity for a short (sell) position.

- Placing Stop Loss: To manage risk, I place my stop loss either above the body of the first or second candle in the bearish FVG formation. This decision depends on my assessment of the market conditions and my risk tolerance.

Leave a Comment